Find consumer tips on everything from credit to home safety to travelling on a budget and so much more!

Freedom to Stream with AT&T's Unlimited Data Plans

Choose from AT&T Unlimited Plus or AT&T Unlimited Choice, and get the following:

AT&T Unlimited PlusSM AT&T Unlimited ChoiceSM

|

|

|

|

|

|

|

|

|

|

|

|

Not going the unlimited route? As a union member, you can save 15% on the monthly service charge of qualified wireless plans6 (excludes unlimited data plans). You can also save 20% on select accessories7 and get the $25 activation fee waived on select devices8.

Not yet an AT&T customer? For a limited time, get up to $650 in bill credits9 when you switch to AT&T, trade in your current smartphone and buy a new one on AT&T Next.

When you visit an AT&T store, you’ll be helped by a fellow union member. Be sure to reference Discount Code 3508840, even if you choose an unlimited data plan, to ensure you can take advantage of the union-member specific benefits, such as the 20% accessory discount and the $25 activation fee waiver. Ask your AT&T store rep which plan is best for you.

Remember that when you choose AT&T, you’re choosing to support the more than 150,000 union members employed there.

AT&T is the only nationwide unionized wireless carrier.

To find a store, or get additional information, visit unionplus.org/att.

1AT&T UNLIMITED CHOICESM: Data speed limited to a max of 3Mbps. Plan is not eligible for Stream Saver, but for content we can identify as video, speed will be at a max of 1.5Mbps at Standard Definition quality (about 480p). Data and video speeds will be capped at amounts shown above, regardless of the network your device is on (for example 4G LTE, 4G or 3G). Tethering and mobile hotspot use prohibited (except for these products: Connected Cars, Hot Spots, and Wireless Home Phone and Internet).

AT&T UNLIMITED PLUSSM: Includes the Stream Saver feature which allows you to save data on content it recognizes as video by streaming higher definition video in Standard Definition quality (about 480p) on compatible devices (unless the video provider has opted out). AT&T will activate the feature for you. Check your account online to see if the feature is active. Once active, you can turn it off or back on at any time at att.com/myatt or call 611. Stream Saver will not recognize all video content. Ability to stream and video resolution may vary, and be affected by other factors. Restrictions apply. See att.com/streamsaver for more details. HD Video: You can turn Stream Saver off at any time to enjoy access to High Definition video streaming, if and when available. Tethering and Mobile Hotspot: Includes up to 10GB per line per month. After 10GB, tethering speed will be slowed to a max of 128Kbps for the rest of the bill cycle (except for these products: Connected Cars, Hot Spots, and Wireless Home Phone and Internet.). Except for those products, all tethering data usage, including sponsored data if tethered, will be impacted and will not be fully functional.

AT&T UNLIMITED CHOICE & PLUS PLANS: For consumers only. Plan includes unlimited talk, text, and data, and Roam North America feature. Pricing: Includes monthly plan charge and per device monthly access charge. AutoPay & Paperless Billing discount: $5 (off single line) or $10 (off multiline) per month discount off your plan charge requires being active and enrolled in paperless billing and AutoPay (excludes credits cards). Discount will start within 2 bill cycles. Offer subject to change and may be discontinued at any time. Devices: Sold separately. Limits: Select wireless devices only. 10 devices per plan. UNLIMITED DATA: For use in the United States, Puerto Rico and the U.S. Virgin Islands (the “Domestic Coverage Area” or “DCA”). Data Restrictions: After 22GB of any data usage on a line in a bill cycle, AT&T may slow the data on that line during periods of network congestion for the remainder of that cycle. See att.com/broadbandinfo for details on AT&T network management policies. UNLIMITED TALK: For phones only. Includes calls within the DCA. Service may be terminated for excessive roaming (see Wireless Customer Agreement at att.com/wca). Unlimited Talk to Canada and Mexico: For phones only. Includes unlimited International Long Distance (ILD) calling from DCA to Mexico and Canada. You may be charged for calls to special or premium service numbers. Calls to Other Countries: Includes ILD service that can be used to call countries other than Canada and Mexico. Per minute pay-per-use rates apply unless have an ILD service package. Rates subject to change without notice. For rates, see att.com/worldconnect. UNLIMITED TEXT: Standard Messaging – Phones only. Includes unlimited messages up to 1MB in size within DCA to more than 190 countries for text messages and 120 countries for picture and video messages. AT&T may add, change, and remove included countries at its discretion without notice. Messages sent through applications may incur data or other charges. See att.com/text2world for details. Advanced Messaging – Sender and recipient(s) must be AT&T postpaid wireless customers with HD Voice accounts, capable devices, have their devices turned on and be within the AT&T-owned and operated DCA (excludes third-party coverage). Includes unlimited messages up to 10MB in size. Other restrictions apply and can be found at att.com/advancedmessaging. Discounts: Plans may not be eligible for offers, credits, or discounts.

ROAM NORTH AMERICA FEATURE: Data: allows domestic plan data usage in Mexico/Canada. Talk: Phones only. Includes calls within Mexico/Canada and from Mexico/Canada to the U.S., Puerto Rico, and U.S. Virgin Islands (collectively with Mexico & Canada, the North America Coverage Area “NACA”). You may be charged for calls to special or premium service numbers. Calls to other countries: International long distance pay-per-use rates apply to calls from Mexico or Canada to countries outside the NACA unless have an ILD service package. Rates subject to change without notice. For rates, see att.com/wcv. Text: Standard Messaging – Phones only. Includes unlimited messages up to 1MB in size within Mexico/Canada and from Mexico/Canada to more than 190 countries for text messages and 120 countries for picture and video messages. AT&T may add, change, and remove included countries at its discretion without notice. Messages sent through applications may incur data or other charges. Visit att.com/text2world for details. Advanced Messaging – not available for use in Mexico or Canada. Usage Restriction: If voice, text or data use in Mexico and/or Canada exceeds 50% of total voice, text or data use for two consecutive months, feature may be removed. Device Restrictions: Service not available on select connected devices, wearables, & connected cars.

2Claim based on the Nielsen Certified Data Network Score. Score includes data reported by wireless consumers in the Nielsen Mobile Insights survey, network measurements from Nielsen Mobile Performance and Nielsen Drive Test Benchmarks for Q2+Q3 2016 across 121 markets.

3AT&T UNLIMITED PLUS VIDEO LOYALTY CREDIT: Limited Time Offer. Excludes Puerto Rico & U.S. Virgin Islands. Avail. to residential U.S. customers. Requires qualifying, AT&T video service and AT&T Unlimited Plus wireless plan (min. $90/mo. after autopay and paperless bill discount). See att.com/unlimited for plan details. Qualifying Video Service: Requires eligible base programming packages from DIRECTV (installation must be complete) or DIRECTV NOW. For new DIRECTV Satellite customers, 24-mo. TV agmt & equip. lease req'd. Early Termination Fee (up to $480), Equipment Non-Return & add'l fees apply. Credit card (except MA & PA) & credit approval req'd. See directv.com or directvnow.com for details on these services. Exclusions: Select promotional, trial and other video packages are not elig. for offer. Credit: Applied as a $25 credit to qualifying video service account each billing period. Credit begins 2-3 billing periods after enrolling in AT&T Unlimited Plus. Credit may not exceed monthly recurring charge of your base package. First time credit will include all credits earned since meeting offer requirements. Cancellation of AT&T Unlimited Plus will result in discontinuance of credit. If you have an outstanding credit balance after cancel DIRECTV NOW account, the credit balance may be applied to your wireless service. Existing Video Service Customers: Customers with two or more qualifying video services must elect the service to be credited or discount is automatically applied to the account AT&T chooses. Limits: One Video Loyalty Credit per wireless account. May not be stackable w/other offers, credits or discounts. Offer, programming, pricing, terms and conditions subject to change and may be discontinued at any time without notice.

GENERAL WIRELESS SERVICE: Subject to Wireless Customer Agmt (att.com/wca). Services are not for resale. Credit approval, activation/upgrade fee (up to $45), other charges & deposit per line may apply. Other Monthly Charges/Line: May include taxes, federal & state universal service charges, Regulatory Cost Recovery Charge (up to $1.25), gross receipts surcharge, Administrative Fee, & other government assessments which are not government required charges. See att.com/additionalcharges for details on fees & charges. Pricing, promotions, & terms subject to change & may be modified or terminated at any time without notice. Coverage & service not available everywhere. You get an off-net (roaming) usage allowance for each service. If you exceed the allowance, your service(s) may be restricted or terminated. Other restrictions apply & may result in service termination. AT&T service is subject to AT&T Network management policies, see att.com/broadbandinfo for details.

4Roaming feature maybe removed if voice, text, or data usage in Mexico and/or Canada exceeds 50% of total voice, text, or data usage for 2 consecutive months.

5Discount is $5/mo. on single lines & $10/mo. on multi-lines. AutoPay excludes credit cards. Discount starts in 1 to 2 bill cycles. Taxes, monthly & other charges are additional. Usage, speed, and other restrictions apply.

615% ON THE MONTHLY SERVICE CHARGE of QUALIFIED WIRELESS PLANS: Available only to current members of qualified AFL-CIO member unions, other authorized individuals associated with eligible unions and other sponsoring organizations with a qualifying agreement. Must provide acceptable proof of union membership such as a membership card from your local union, a pay stub showing dues deduction or the Union Plus Member Discount Card and subscribe to service under an individual account for which the member is personally liable. Offer contingent upon in-store verification of union member status. Discount subject to agreement between Union Privilege and AT&T and may be interrupted, changed or discontinued without notice. Discount applies only to recurring monthly service charge of qualified voice and data plans, not overages. Not available with unlimited voice or unlimited data plans. For Family Talk, applies only to primary line. For all Mobile Share plans, applies only to monthly plan charge of plans with 1GB or more, not to additional monthly device access charges. Additional restrictions apply. May take up to 2 bill cycles after eligibility confirmed and will not apply to prior charges. Applied after application of any available credit. May not be combined with other service discounts. Visit unionplus.org/att or contact AT&T at 800-331-0500 for details.

720% OFF SELECT ACCESSORIES: AT&T will apply the Accessory Discount to the prices of select Accessories available through AT&T, which may be modified by AT&T from time to time. The term "Accessory" or "Accessories" means supplementary parts for Equipment (e.g. batteries, cases, earbuds). The Accessory Discount will not apply to Accessories purchased for use with datacentric Equipment such as modems, replacement SIM cards and car kits or to Apple-branded Accessories, and the Accessory. Discount may not be combined with any other promotional pricing or offer.

8$25 waived activation fee on select devices.

9SWITCH TO AT&T: Each line reqs an eligible port-in, trade-in, purchase, svc & final bill submission. Credits received may not equal all costs of switching. Elig. port-in: From eligible carrier (excludes Cricket & select others) on their term agmt or device plan (excludes 3rd party agmts). Must buy elig. smartphone in same transaction. Elig. Purchase/Svc: Smartphone on AT&T Next or AT&T Next Every Year installment agmt w/elig. svc (excludes prepaid, Lifeline, Residential Wireless and select discounted plans). Acct & svc must remain active & in good standing for 45 days. Tax due at sale. Down payment may be req'd. If svc is cancelled, installment agmt balance (up to $950) is due. Limit: Purch. limits apply. Trade-in: Select locations. Must be smartphone on line ported, be in good working condition w/min. $5 trade-in value & meet AT&T Trade-In program reqmts. Trade-in Credit: Instant credit or AT&T VISA Promotion Card issued by MetaBank™ or CenterState Bank of Florida NA, via license from Visa U.S.A. Inc. (may take 3 weeks to receive). Not redeemable for cash & non-transferable. Credit/Card valid for 5 months & for use only to purch. AT&T products & svc in AT&T owned retail stores, at att.com, or to pay wireless bill. Add'l cardholder terms & conditions apply & are provided w/Promotion Card. At dealers get credit (w/add'l terms) for use at dealer. Final Bill: Must go to att.com/helpyouswitch & upload or mail final bill w/in 60 days showing Early Termination Fee (ETF) or device plan balance (incl. lease purch. costs) on number ported. Final Credit: Total amount equals device balance/ETF (excludes taxes, fees, svc & other charges) up to $650 minus trade-in. Get up to $645 for device plan balance or up to $345 for ETF. W/in 4 wks after meet all elig. reqmts, will be mailed AT&T VISA Promotion Card issued by MetaBank™ or CenterState Bank of Florida NA, via license from Visa U.S.A. Inc. Not redeemable for cash & non-transferable. For use at US locations where Visa cards are accepted through date printed on card (min. 150 days). Add'l cardholder terms & conditions apply & are provided w/Promotion Card. See att.com/switch for details.

Gen. Wireless SVC: Subj. to Wireless Customer Agmt (att.com/wca). Svcs not for resale. Deposit may be reqd. Credit approval, activ., other fees, monthly, overage, other charges, usage, other restrs apply. Pricing & terms subject to change & may be modified or terminated at any time without notice. Coverage & svc not avail. everywhere. You get an off-net (roaming) usage allowance for each svc. If you exceed the allowance, your svc(s) may be restricted or terminated. Other restrs apply & may result in svc termination.

With AT&T’s Unlimited Data Plans1, you can enjoy unlimited streaming and surfing on all your devices on America’s best data network2.

Find Your Perfect Vehicle Match with Union Plus

* Between 7/1/16 and 9/30/16, the average estimated savings off MSRP presented by TrueCar Certified Dealers to users of TrueCar powered websites, based on users who configured virtual vehicles and who TrueCar identified as purchasing a new vehicle of the same make and model listed on the certificate from a Certified Dealer as of 10/31/2016, was $3,106. Your actual savings may vary based on multiple factors including the vehicle you select, region, dealer, and applicable vehicle specific manufacturer incentives which are subject to change. The Manufacturer's Suggested Retail Price ("MSRP") is determined by the manufacturer, and may not reflect the price at which vehicles are generally sold in the dealer's trade area as not all vehicles are sold at MSRP. Each dealer sets its own pricing. Your actual purchase price is negotiated between you and the dealer. TrueCar does not sell or lease motor vehicles.

**EPA Green Car Make and Models Include:

- Chevrolet — Cruze, Cruze Diesel, Malibu and Sonic

- Chrysler — 200

- Ford — Focus and C-Max

Searching for a new vehicle can be overwhelming! So get some free help finding the right new or used car or truck for you and your family. Check out this video to see what the Union Plus Auto Buying Service, administered by TrueCar™, has to offer you.

Beware the Hidden Costs of Homeownership

Home Insurance

At closing, you may have been required to pre-purchase a year of homeowner's insurance. Homeowner’s insurance often costs quite a bit more than renter’s insurance, because it covers the home, in addition to your personal property. Depending upon where you live, you may also need to purchase supplemental insurance for hurricanes, floors, tornadoes, earthquakes, and other natural disasters that are not covered under your standard policy. In addition, if you own any valuable items, such as sports memorabilia or jewelry, you may want to add coverage specifically for those items.

Maintenance and Repairs

Owning a home also means that you are responsible for all maintenance and repairs. These costs can add up quickly, especially in an older home with older systems. These expenses can include the cost to repair or replace appliances, heating and cooling systems, exteriors, and anything else that needs to be fixed. Every year, you should expect to spend some money on routine maintenance, and always keep an emergency fund with money available for emergency repairs. Keeping up with routine maintenance, although expensive in the short-term, will ultimately save you money in the long-term.

Home Utilities

Also prepare to spend some additional money on utilities, including water, garbage collection, heat, and electricity. With more space, it’s likely that even the bills you paid when you rented will be higher in your new home.

Homeowners’ Association Fees

Many communities have a homeowners’ association, commonly called an HOA. An HOA is typically tasked with maintaining common areas and enforcing deed restrictions. Membership in a community HOA is often mandatory and members are charged a monthly or annual fee.

Home Furnishings

Finally, keep in mind that you’ll need to purchase furniture and décor items for your new home. Most people, when purchasing a new home, decide to paint, upgrade the décor, purchase new furniture, and buy new linens.

When purchasing a new home, factor in these items to your total budget to make sure that you are completely financially prepared for homeownership. By doing this, you’ll know that you are purchasing a home that you can afford.

Union Plus Credit Counseling

Union members can get a no-obligation money and credit assessment from certified, experienced consumer credit counselors though Union Plus Credit Counseling. Powered by the non-profit Money Management International (MMI), your free session will cover a complete financial review, assistance in budgeting, advice for working with creditors, and more.

Are you planning to buy a new home? If you are making the move from renter to homebuyer, you are likely to find that there are some hidden costs to ownership — costs that you probably never thought about when you were renting. Starting at your closing, additional housing expenses that you hadn’t considered might cost you money you were never expecting to spend.

Improve Your Chances of Getting a Loan by Learning What Lenders Look For

Through the Union Plus® Mortgage program, with financing provided by Wells Fargo Home Mortgage, union members, their parents and children have access to a wide range of home loan options to meet a variety of needs, plus access to special benefits designed for union families.

When you apply for a loan, lenders assess your credit risk based on a number of factors, including your credit/payment history, income, and overall financial situation. Here is some additional information to help explain these factors, also known as the “5 Cs,” to help you better understand what lenders look for:

- Credit history: Qualifying for the different types of credit hinges largely on your credit history – the track record you’ve established while managing credit and making payments over time. Your credit report is primarily a detailed list of your credit history, consisting of information provided by lenders that have extended credit to you. While information may vary from one credit reporting agency to another, the credit reports include the same types of information, such as the names of lenders that have extended credit to you, types of credit you have, your payment history, and more.

In addition to the credit report, lenders may also use a credit score that is a numeric value – usually between 300 and 850 – based on the information contained in your credit report. The credit score serves as a risk indicator for the lender based on your credit history. Generally, the higher the score, the lower the risk. Credit bureau scores are often called “FICO® scores” because many credit bureau scores used in the U.S. are produced from software developed by Fair Isaac Corporation (FICO). While many lenders use credit scores to help them make their lending decisions, each lender has its own criteria, depending on the level of risk it finds acceptable for a given credit product.

- Capacity: Lenders need to determine whether you can comfortably afford your payments. Your income and employment history are good indicators of your ability to repay outstanding debt. Income amount, stability, and type of income may all be considered. The ratio of your current and any new debt as compared to your before-tax income, known as debt-to-income ratio (DTI), may be evaluated.

- Collateral (when applying for secured loans): Loans, lines of credit, or credit cards you apply for may be secured or unsecured. With a secured product, such as an auto or home equity loan, you pledge something you own as collateral.

The value of your collateral will be evaluated, and any existing debt secured by that collateral will be subtracted from the value. The remaining equity will play a factor in the lending decision.

- Capital: While your household income is expected to be the primary source of repayment, capital represents the savings, investments, and other assets that can help repay the loan. This can be helpful if you lose your job or experience other setbacks.

- Conditions: Lenders may want to know how you plan to use the money and will consider the loan’s purpose, such as whether the loan will be used to purchase a vehicle or other property. Other factors, such as environmental and economic conditions, may also be considered.

The 5 C’s of Credit is a common term in banking. Now that you know them, you can better prepare for the questions you may be asked the next time you apply for credit.

And remember, after closing on a loan through the Union Plus Mortgage program, you’ll be eligible for special benefits that include receiving a My Mortgage GiftSM award from Wells Fargo - $500 for buying a home or $300 for refinancing your home – for use at participating retailers, and access to mortgage assistance through Union Plus in times of hardship such as layoff, disability or strike.1 Keep in mind that parents and children of union members are also eligible for certain benefits.

Talk to a

Union Plus Mortgage Specialist

at 866-802-7307

or request a personal consultation

Source: wellsfargo.com

1Eligible individuals can receive the Wells Fargo My Mortgage GiftSMaward approximately 6 weeks after closing on a new purchase or refinance loan secured by an eligible first mortgage or deed of trust with Wells Fargo Home Mortgage (“New Loan”), subject to qualification, approval and closing, when identifying themselves as eligible. The My Mortgage GiftSM award is not available with any Wells Fargo Three-Step Refinance SYSTEM® program, The Relocation Mortgage Program® or to any Wells Fargo team member. Only one My Mortgage Gift award is permitted per eligible (“New Loan”). This award cannot be combined with any other award, discount or rebate, except for yourFirstMortgageSM. This award is void where prohibited, transferable, and subject to change or cancellation with no prior notice. Awards may constitute taxable income. Federal, state and local taxes, and any use of the award not otherwise specified in the Terms and Conditions (also provided at receipt of award) are the sole responsibility of the My Mortgage GiftSM recipient.

Wells Fargo Home Mortgage has a services agreement with Union Privilege in which Union Privilege receives a financial benefit for providing agreed upon services. You are encouraged to shop around to ensure you are receiving the services and loan terms that fit your home financing needs.

Information is accurate as of date of distribution. Wells Fargo Home Mortgage is a division of Wells Fargo Bank, N.A. © 2018 Wells Fargo Bank, N.A. All rights reserved. NMLSR ID 399801

![]()

When you apply for a loan, lenders assess your credit risk based on a number of factors, including your credit/payment history, income, and overall financial situation. Here is some additional information to help explain these factors, also known as the "5 Cs," to help you better understand what lenders look for:

How To Know If You Need Flood Insurance

It’s a good idea to think about flood insurance in advance of an event, because standard homeowners policies exclude flood coverage. You can find out whether your property is in a low-, moderate- or high-risk flood area by entering your address into the Federal Emergency Management Agency (FEMA) database. Keep in mind, however, that 25 percent of all flood claims are from people who don’t live in high-risk areas. And because of the recent boom in new housing developments, the land’s natural runoff pattern might have changed from what a 10-year-old flood map shows.

MetLife Auto & Home is proud to offer our customers flood insurance through the National Flood Insurance Program (NFIP) and Federal Emergency Management Agency (FEMA), and it covers more than just the structure of your home. It also covers debris removal, damage to your contents and more. Contact your local MetLife Auto & Home representative or call one of our flood specialists toll free at 855-666-5797.

L0915436452[exp0917][All States][DC]

MetLife Auto & Home offers flood policies through the National Flood Insurance Program (NFIP) and Federal Emergency Management Agency (FEMA), covering your home’s structure and any debris removal necessary.

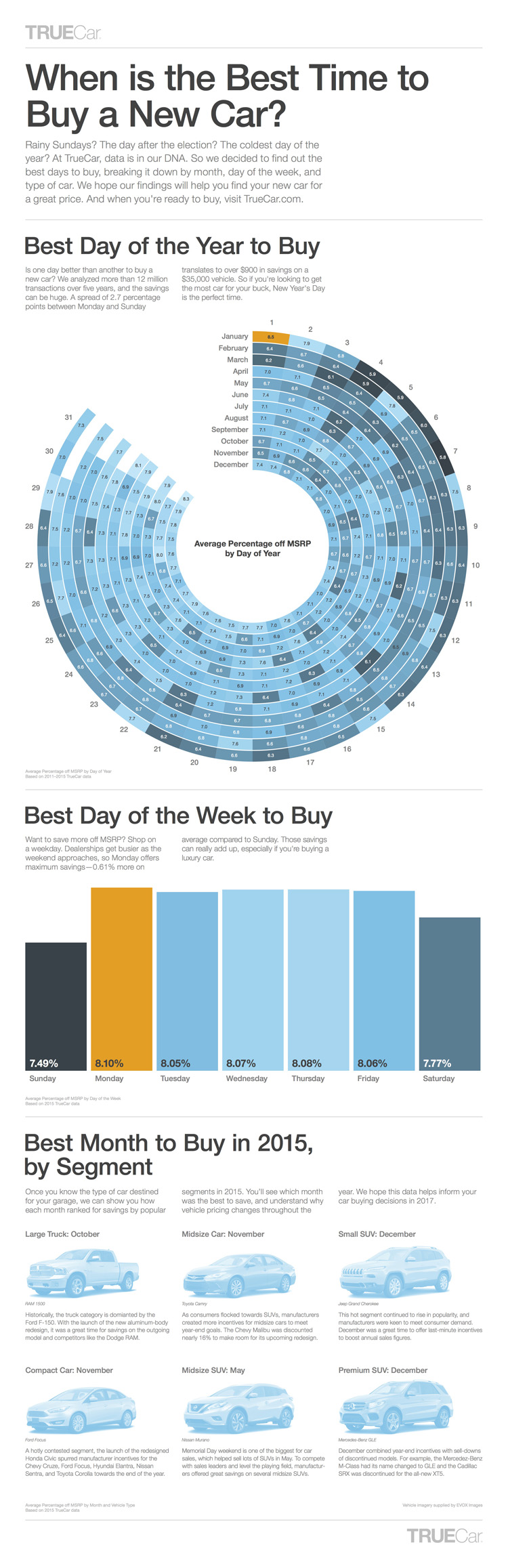

The Data Behind the Best Times to Buy a New Car

Car prices change all the time, for all kinds of reasons. Using industry sales data from previous years, the experts at TrueCar identified the best times to buy a new car by month, day and even segment.

TrueCar, which powers the Union Plus Auto Buying Service, has analyzed more than 12 million transactions over five years to determine which day of the year is the best to buy a vehicle. The savings can be huge!

Spring Cleaning Your Finances

Keeping sufficient records and updated copies of important paperwork is vital to your financial well-being. In the event of an emergency, having important papers organized is just as important as having an emergency savings fund.

The first thing you must do is gather original copies of your important documents. If it isn't possible to obtain an original copy of a document, get a certified copy. Once you have the necessary documents, be sure to keep them in a safe, yet easily accessible place - either a secure paper filing system or a trustworthy online space. The following information can help you determine what to keep and what to toss.

Retirement planning documents – Documents pertaining to IRA, 401(k), 403(b), or TSA statements should be kept in a secure location, such as a safe deposit box. Keep the annual summaries until you retire or close the account.

Tax planning documents – According to the Internal Revenue Service you should keep your individual tax return documents for seven years. You may also want to save W-2s. Paycheck stubs can be shredded once they are checked against your W-2.

Financial documents – Checking and savings accounts, bank and credit card statements, and bank information are important paperwork to have, but should be kept in a secure location. Bills for big purchases, such as furniture, computers, etc. should be kept in an insurance file for proof of their value in the event of loss or damage. Any unneeded financial statements should be properly disposed to avoid identity fraud.

Asset protection documents - In the event of an emergency, you’ll want to make sure your tangible assets are protected as well as your most valuable asset—yourself. Make sure you have updated, accurate records of medical, home, and life insurance policies and statements. Documents pertaining to buying, selling, or improving your home should be kept as long as you own the home.

Estate planning documents – It’s important to have a copy of any wills and power of attorneys. These are documents that your attorney should also have on file.

Shuffling through a pile of paperwork is a daunting task. But it is well worth it to make sure documents are properly filed and stored. Getting your financial house in order now will ensure peace of mind down the road.

Union Plus Credit Counseling

Union members can get a no-obligation money and credit assessment from certified, experienced consumer credit counselors though Union Plus Credit Counseling. Powered by the non-profit Money Management International (MMI), your free session will cover a complete financial review, assistance in budgeting, advice for working with creditors, and more.

Spring is just about here and that means it’s time for spring cleaning. Beyond simply cleaning your house, this is a great opportunity to get your financial paperwork in order.

How to Take a Cool Listing Photo

Here are some tips and tricks for ensuring your MLS listing catches some attention.

- Hire or DIY: This is the first decision you need to make. Whether you’re FSBO or have a realtor – think about investing in having a professional take pictures of your home. They will have a good eye for lighting, camera angles to make your home larger and also special lenses to enhance the look of rooms. If you enjoy photography and have a good camera – there’s no reason to shy away from the job, but just be sure to follow the below steps to ensure you’re thinking about everything before you begin.

- De-clutter and De-personalize: This is something you’ll hear from a realtor when getting your home “show ready” – the less clutter and personal items, the better. Invest in totes or an actual storage service if you’re not ready to get rid of things.

- Light: When you take pictures, make sure it’s during the brightest point of the day (in your home). Depending on where your windows are located and the position of your home – it could be in the morning or afternoon. Open all blinds and shades to let ample light in and notice how much more inviting your home will look in your pictures.

- Set the Scene: Think about buying fresh flowers for your dining room table, side tables, bathrooms or guest room. Set your dining room table with a beautiful tablecloth and place settings. Buy potted flowers for your porch and back yard. Buy a cozy throw to add color to your couch or bedroom. Remember you can always re-use things like plants and flowers in multiple rooms to add a pop of color to your pictures. Get inspired by thumbing through recent Pottery Barn magazines to see how they’ve staged their rooms – even the smallest details can make a big difference.

- Highlight Your Best Features: If you have a beautiful kitchen or large backyard – be sure to highlight these areas with multiple pictures. You can never have too many good pictures for prospective buyers to view.

With these tips, you shouldn’t have any issues capturing some attractive pictures of your home. And as always, if you’re ready to talk to one of SIRVA pre-approved real estate agents, call 800-284-9756. With the Union Plus Real Estate Rewards, union members earn $500 cash back on every $100,000 in home value when you use a real estate agent approved by SIRVA.

If you’re thinking about going the For Sale by Owner (FSBO) route or you’re trying to prep your home for professional pictures – either way, you’ll need a few photography tips in order to show your home in the best light (literally).

Why Do Car Prices Change?

The Union Plus Auto Buying Service is committed to a faster, easier buying experience. One part of the process you may be wondering about is the tendency for car prices to change. The simple answer is supply and demand.

The base price or manufacturer suggested retail price (MSRP) of a particular car does not fluctuate much. But to meet or drive changes in demand, manufacturers often offer incentives such as cash back or bonus cash. Dealers have the same opportunities to offer incentives based on their stock, which often happens towards the end of the month.

For example, one dealership might project high sales of a popular model. A smaller dealership in a different city doesn’t, requesting fewer vehicles from the manufacturer. This second dealer might not offer incentives because they believe their smaller inventory will sell, while the first offers them to quickly move more vehicles.

While prices fluctuate, using a platform like the Union Plus Auto Buying Service, you can receive upfront pricing information from participating dealers that includes available dealer and manufacturer incentives. The Union Plus Auto Buying Service uses TrueCar Certified Dealers who will help you find the vehicle you want and locate incentives you may qualify for, including potential extra savings.

We want to empower consumers with the information they need to feel confident throughout the entire car-buying process. Knowing why car prices change will help you get a great deal.

What to Do When You Cannot Make Your Payments

When your income suddenly decreases or disappears completely, the question quickly becomes what do you do about all those bills you're supposed to be paying? If you find yourself in such a situation, the best first step is always is to communicate with each of your creditors explaining your situation. Tell them that you are unable, not unwilling, to repay as agreed. Remember, it is always best to contact your creditors before they have to contact you.

The best way to contact your creditors is in writing; after you have written your letters:

- Maintain accurate files. Before mailing your letters, make copies to keep for your files. If you must negotiate over the phone, keep detailed notes including the representative’s name, title, and phone number. Follow-up any phone conversations in writing.

- Stay organized. Write a summary list of your financial plan for quick reference. Revisit the plan regularly to make sure you are on-track.

- Be prepared for calls. After sending your letters, you can expect some of your creditors to call with additional questions. If they do, be honest and courteous.

- Keep your end of the bargain. If you are unable to make agreed upon payments, contact your creditors immediately to renegotiate.

Utility Companies

Each utility company has its own procedure to follow before disconnecting service. The procedure generally includes notification in person, by mail, or by phone. Before shutting off service, the company may offer a budget plan to help you repay any past due amount. Remember, utility companies do not want to discontinue your service. They might even have information about available emergency funds to help you pay past bills.

Be sure to ask for help at the first sign of financial trouble. Once your utilities are disconnected, you may have to pay the past due bill in full or pay a substantial deposit to reinitiate service. You might also have to reapply for the utility and pay installation charges.

Housing lenders

If you do not make your mortgage payments, you home could be foreclosed. Fortunately, there are many alternatives to foreclosure. For example, if you have the amount of money required bring your loan current, the mortgage company will reinstate your mortgage. You may also contact your mortgage company and work out a repayment plan.

For help, considering speaking with a HUD-certified housing counselor. If your home loan is backed by the Department of Veteran’s Affairs, call your local VA center. You can also check with your local United Way for assistance.

If you are a renter, contact your landlord about your situation immediately. The landlord may accept partial payment for one or two months. You may want to look for less expensive housing, but be realistic and remember to include moving expenses, deposits and family adjustments as you calculate costs. If it is a private landlord and you or family members are able, you may be able to do some maintenance work in place of part of your rental costs.

Car and Other Vehicle Lenders

If you cannot make your car or other vehicle payments, they may be repossessed. Repossession means that the creditor takes the vehicle and it is sold at a public or private auction. If the vehicle is sold for less than the amount still owed on it, as is often the case, you are liable for the remainder that is owed on the vehicle.

Check with the creditor to see if the loan can be rewritten for lower monthly payments. Ask for an extension, with the extension fee attached to the end of the loan. If you do not need the vehicle, if it is a second car or a recreational vehicle, ask the creditor if you could sell the vehicle and pay the creditor off with what you receive. Also, find out about the procedure if you sold the vehicle to someone who would take over payments.

Credit Card Issuers

Late fees and over-the-limit charges can quickly add up to a debt problem. In addition, nonpayment could lead to your accounts being canceled and the debt may be turned over to a collection agency.

Notifying your creditors of your changed financial situation may not stop all collection activity; however, many creditors are likely to assist by waiving interest, granting extensions, or reducing payments. Do not be tempted to replace income with credit card cash advances. Available credit should be used extremely cautiously.

Insurance Issuers

Do not allow insurance to lapse. Write your insurers immediately and explain your situation. Ask what payment options are available. Check with your insurance company; there may be a grace period in making payments from 10 to 30 days. Determine your minimum needs for insurance. Cancel duplicate and non-essential policies. For basic essential policies consider these options:

- Car Insurance. By law, you may need to retain your liability coverage. You can research the possibility of reducing your premium costs by increasing the deductible on your collision and comprehensive coverage.

- Health Insurance. Check to see if the health insurance provided by your former employer is continued. If coverage is not available or if you can’t afford the premium, find out if you qualify for Medicaid. Also, check into policies that would pay for major hospitalization and find out what community services are available for routine medical concerns.

- Life Insurance. Consider changing your policy to a less expensive form. Check into the possibility of borrowing money on your policy to pay premiums.

Union Plus Credit Counseling

Union members can get a no-obligation money and credit assessment from certified, experienced consumer credit counselors though Union Plus Credit Counseling. Powered by the non-profit Money Management International (MMI), your free session will cover a complete financial review, assistance in budgeting, advice for working with creditors, and more.

When the bills are due and you can't pay, take a breath, and utilize this article to evaluate your options.